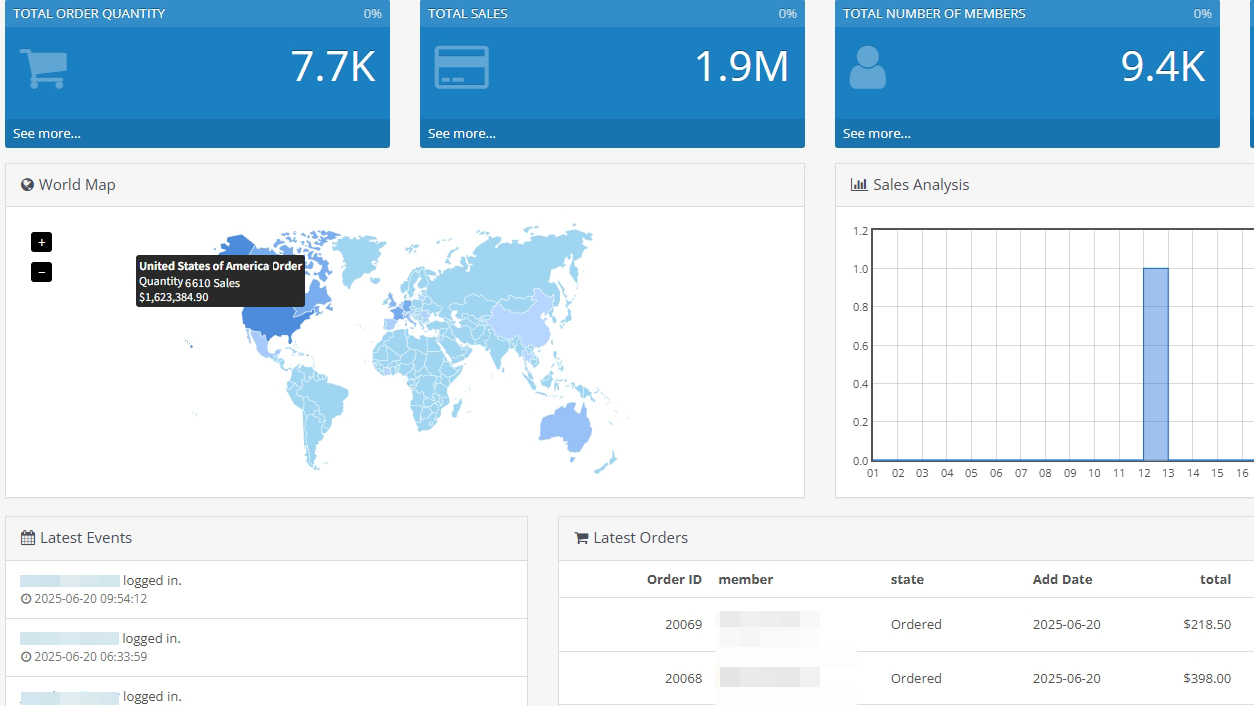

Over the past few years, as our incubation and training program has steadily expanded, we’ve seen countless clients achieve real success — securing a growing number of orders and building momentum in their online businesses. This success is no accident. It stems from a combination of smart product selection, strategic ad spending, and, most importantly, the dedicated support and collaboration between our media buying clients and our Xiamen-based operations team.

From day one, our mission has been clear: to help our clients build real, profitable businesses. This has always been the goal of our team as we work to develop a healthier ecosystem in this niche. In our view, mutual success is the foundation of lasting partnerships — because when our clients are eating meat, we at least get to drink the soup.

But while strong sales are important, a stable payment solution is what truly keeps the engine running. Behind every successful replica store or high-risk product niche is a reliable way to receive payments — and today, PayPal remains one of the most critical tools in that process.

That’s why we emphasize the safe, compliant, and long-term use of PayPal accounts as a key factor in your business survival and growth. With proper setup, usage strategies, and risk control, your PayPal account can become a strong pillar of support — not a liability.

In the rest of this blog, we’ll share actionable insights on how to:

- Avoid account limitations and bans

- Structure your PayPal setup to reduce risk

- Use PayPal in a way that supports long-term scaling

Whether you’re new to replica products or already running a profitable store, getting PayPal right is no longer optional — it’s essential.

Let’s get straight to the point.

When it comes to receiving payments for replica products, how can we use PayPal in a safe, compliant, and structured way to ensure everything runs smoothly?

As we’ve briefly mentioned in previous articles:

For PayPal, whether you’re selling replica or general products is not always the most critical issue. What truly matters is how your account is used.

What does that mean?

Can you just connect PayPal directly to your replica store and start taking payments openly?

Absolutely not. After all, PayPal is a massive global corporation that still respects intellectual property rights. It’s not going to turn a blind eye to counterfeit-related risks.

So, if you’re running a replica-focused own e-commerce store, you still need to maintain some baseline discipline.

To avoid problems, we strongly recommend reviewing the latest strategies in 2025 for AB site setups and rotational account usage.

For Small-Volume Sellers: Usage Matters More Than Product Type

If your transaction volume is low, PayPal cares more about your account behavior — login consistency, dispute rates, usage patterns — rather than just where the money is coming from.

In other words:

A new account isn’t the problem — an improperly used new account is.

Even if you’re starting from scratch with zero accounts, there’s no issue.

You can register a new PayPal account, follow best practices, build trust over time, and gradually grow a batch of high-quality, stable, and reliable accounts for replica-related payments.

In the next section, we’ll start from the very beginning — how to register a new PayPal account correctly — and walk through every step you need to take to build a high-trust account from zero.

①. Registration

There aren’t many tricks in the PayPal registration process, but there are a few important things to keep in mind.

You can choose to register either a Personal account or a Business account — both can be used to receive payments in a replica product setup.

1). Use Real, Clean, and First-Time Materials

All registration information must be real, valid, and fully under your control — such as ID cards, business licenses, passports, addresses, and phone numbers.

Do not use random or purchased documents from the internet. This can lead to issues during identity verification steps, such as face recognition or business authentication.

Also, make sure all materials are being used for the first time only. If PayPal detects any connection to previously used or flagged data, your newly registered account may be quickly restricted or permanently closed.

2) . Use a Clean and Genuine Network

Registering a PayPal account is your first direct interaction with PayPal. At this stage, being honest and transparent is the best approach.

Never use a VPN on your own network—this is a major taboo!

For example, if you plan to develop the UK market and register a UK PayPal account, that’s fine. However, you cannot use a UK VPN to log in and operate the account while you are physically in the US. PayPal can detect this and may suspect your account has been hacked, triggering reviews or even account suspension.

Always remember: use the local network of your actual location for registration and daily use. Avoid VPNs at all costs, as they can backfire and raise suspicion. PayPal may question your registration intent or suspect someone else is misusing your data from a different location. This can activate PayPal’s identity verification process.

Many users have experienced unexpected account reviews simply because they used a VPN, without any other apparent reason.

3). Avoid Linking: Keep Everything Clean and Isolated

One of the main reasons PayPal accounts get quickly shut down after registration is account linking — usually caused by reusing the same devices, networks, or identity materials.

For example, registering a new account on a computer or network that was previously banned, or using previously registered information (such as ID, business license, phone number) will likely trigger PayPal’s system and result in an immediate ban.

Both software and hardware environments matter — including your device, browser, IP address, network card, hard drive ID, etc.

If a computer has been used to register a banned PayPal account before, do not use it again.

If your resources are limited, consider using anti-detection or multi-instance tools to keep environments fully isolated.

Also, make sure all materials — business license, ID card, phone number, bank account, etc. — are 100% unique and never reused across accounts.

Reusing anything that’s been flagged in the past will very likely lead to instant detection and account suspension.

②. Account Warming and Trust Building

Once your PayPal account is successfully registered, you should start a warming-up process to gradually increase its trust level and stability. This can be done through the following steps:

1). Link a Bank Card

Bind a new, unused credit card to your PayPal account. This helps increase PayPal’s trust in your account.

A Visa card is easy to apply for through most banks. Once you have it, link it directly to your account.

2). Stable IP Environment

Always log in using a stable and clean IP address.

Never use a VPN or proxy. These are red flags to PayPal’s risk control systems.

If you need to manage multiple PayPal accounts, consider using VPS hosting or anti-detection browser tools to simulate separate, isolated login environments.

3). Simulate Real User Behavior

Perform actions that mimic normal user activity:

-

Manually enter your login credentials

-

Click around inside the PayPal dashboard

-

Log out and clear your browser cache

-

Log back in manually next time

In short, everything should look like it’s done by a real human. You can do this casually whenever you have time — consistency helps.

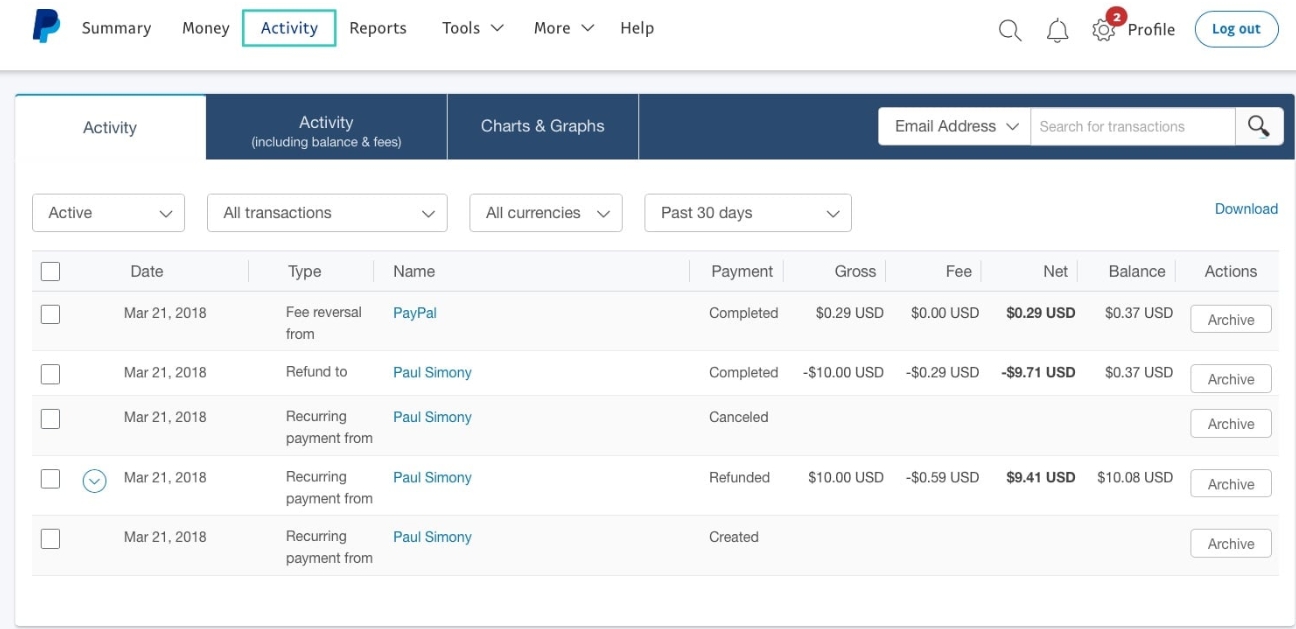

4) . Create Small Transaction History

If possible, start generating small transaction flows using your PayPal account.

For example:

-

Receive $0.50 per transaction

-

Limit to 1–2 transactions per day

-

Avoid frequent or high-value transfers early on

You can ask trusted friends to send small payments or use reliable payment services.

The goal is to build organic transaction history, which helps increase your account’s trust level and reduces the risk of triggering PayPal reviews later on.

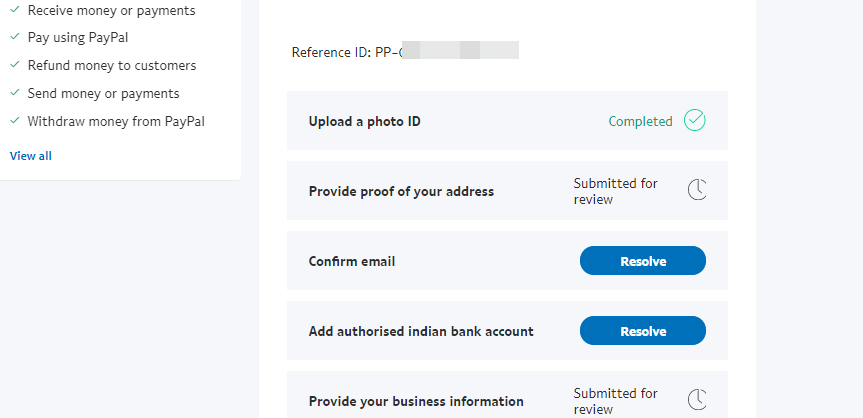

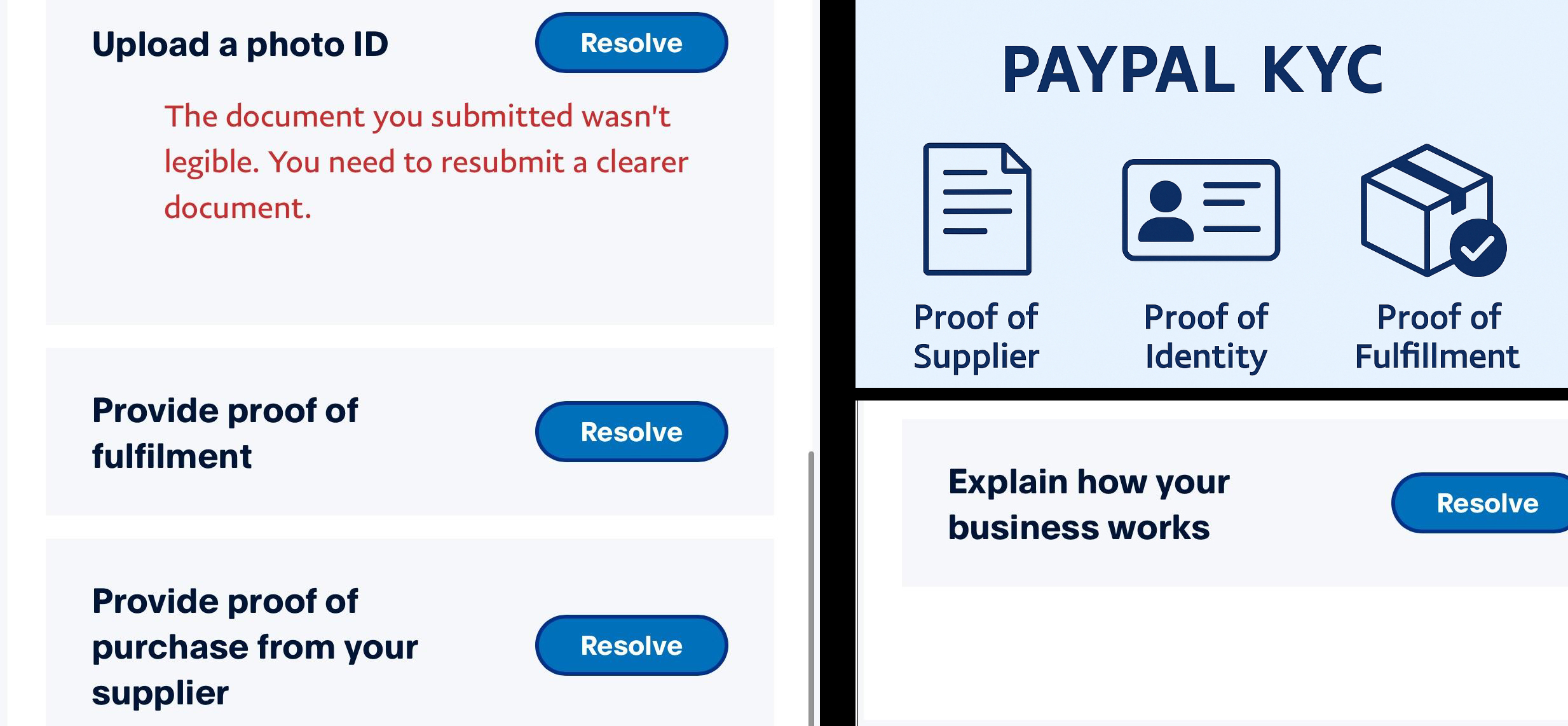

5). PayPal KYC Review Process

At some point during your transactions, your PayPal account will likely face a KYC (Know Your Customer) review. This is a standard compliance step, especially for newly registered accounts.

PayPal may ask you to submit supporting documents to verify your business. Typical questions include:

-

Where do you source your products?

-

What shipping method do you use?

-

Can you provide tracking numbers?

-

What exactly are you selling?

Think of it like opening a bank account — the clerk asks questions to understand who you are and what you’re doing.

Important: Provide Carefully Prepared Documents

Never upload random or incomplete documents. Poor-quality submissions may lead to account bans.

Focus on accuracy and consistency. If your KYC is approved, your account will gain more trust and fewer restrictions.

After passing the review and processing some initial orders, your account’s reputation score and payment release speed will gradually improve. In some cases, payments may even be released instantly — meaning your account is becoming truly stable and reliable.

③. PayPal Account Suspension Tips

Here are key risk points that can easily lead to a PayPal account suspension:

1) .Environment

This refers to your login IP and device. Unless you’re using proper isolation tools, always use a real, local network environment.

Do not use VPNs to log in—PayPal may treat it as suspicious behavior and flag your account.

2). Account Linking

Using the same computer, network, browser, or registration materials (ID, business license, etc.) for multiple accounts can lead to account association, which PayPal treats as high-risk. This often results in immediate account suspension.

3) .Unverifiable Credentials

If your account is missing a valid verification card or cannot pass identity verification (especially during KYC reviews), it may get suspended.

This often happens with purchased accounts. Many of these accounts are unstable and cannot pass verification. Once reviewed, they are easily banned.

Managing a PayPal account is like raising a child—the one you build and grow yourself is the most reliable.

No matter how good a purchased account looks, it’s never more trustworthy than one you’ve registered yourself with clean, verifiable information.

4). Abnormal Transactions

For new PayPal accounts, abnormal transaction activity is a red flag. It’s like opening a new bank account and suddenly receiving a large sum—it immediately triggers risk controls.

Be patient. Good things take time. In the beginning, only process small transactions. Start with daily amounts of $50 to a few hundred dollars. Do not receive over a thousand dollars in a short time. This can easily trigger PayPal’s risk monitoring and KYC review.

If you expect higher volume from the start, but the account is new, consider using a multi-account rotation strategy to share the load. This reduces pressure on a single account and helps ensure long-term stability.

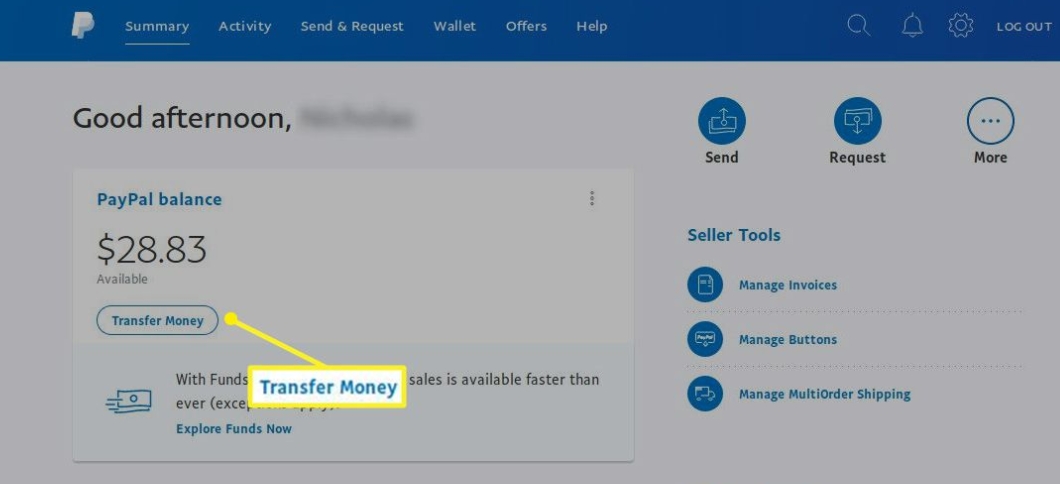

5). Withdrawals

After receiving payments, PayPal will apply a standard 21-day hold for new accounts. The reason is simple: new accounts lack transaction history and trust. PayPal needs to make sure the seller is legitimate, not someone who will withdraw funds and disappear without delivering the product.

During the 21-day period, make sure to prepare and ship orders quickly. Upload the tracking numbers to the PayPal system as soon as the products are sent. If the tracking shows delivery or the buyer confirms receipt, and no dispute is filed, PayPal may release the funds early.

Otherwise, funds will automatically be released after 21 days.

When withdrawing funds, avoid withdrawing 100% of your balance. This behavior might make PayPal suspicious that you’re planning to cash out and leave.

Instead, withdraw 80–85% to maintain trust. Even with old accounts that support instant withdrawal, it’s better to wait 2–3 days and avoid withdrawing the full amount. This helps keep your account in good standing and reduces the chance of review.

6). Customer Disputes

Customer complaints are everything. No matter what you’re selling, too many disputes will ruin your account.

PayPal’s policy strongly favors buyer protection. If your dispute rate is high, nothing else matters—even if you’re selling 100% legitimate products. On the other hand, if you maintain a low dispute rate and handle customer issues well, PayPal is much more flexible, even for sensitive categories.

So, no matter if you’re aiming to meet PayPal’s compliance standards or looking to build long-term customer trust, product quality and after-sales service must always be your top priority.

Once you’ve completed all the foundational work for your PayPal account — from clean registration to safe usage, proper KYC, and healthy transaction behavior — there’s still one critical step left:

You need a strong technical solution to avoid detection and ensure compliance.

As we mentioned in yesterday’s article:

“The Latest 2025 Replica Store Payment Solution for Own e-commerce Sites.”

With the right payment structure and technology in place, your replica product store can operate safely, stably, and smoothly — without unnecessary risk.

Custom E-commerce Solutions for High-Quality Designer-Inspired Fashion Replicas | Website Development, Dropshipping, Payment Integration for PayPal and Stripe, Ad Cloaking Services

Custom E-commerce Solutions for High-Quality Designer-Inspired Fashion Replicas | Website Development, Dropshipping, Payment Integration for PayPal and Stripe, Ad Cloaking Services

![5 Best WordPress Themes for Replica Product International Trade Websites [Recommended]-Custom E-commerce Solutions for High-Quality Designer-Inspired Fashion Replicas | Website Development, Dropshipping, Payment Integration for PayPal and Stripe, Ad Cloaking Services](https://replicasmaster.com/wp-content/uploads/2025/06/1-1-220x150.jpg)