In one of my earlier articles, I shared a detailed breakdown of the payment solutions that my team and I have developed for replica cross-border e-commerce operations. That guide focused heavily on technical workflows, using code-level explanations and backend logic—ideal for developers and engineers, but understandably difficult for readers without a background in programming.

However, since payment processing remains the single most critical pain point for most replica e-commerce sellers, and because I continue to receive countless questions about this very topic, I’ve decided to create a simplified version of that guide.

In this article, I’ll explain the core framework and logic behind how replica e-commerce independent sites (so-called “AB sites”) handle payments in 2025. This time, I’ll do it in a way that is clear and easy to follow—even if you have zero technical or coding knowledge.

Whether you’re just starting your own store or looking for a more secure and scalable payment setup, this overview will help you better understand how modern replica sellers are building and operating around increasingly strict global financial scrutiny.

Before We Begin: 3 Important Notes About This Payment Framework

Before diving into the main framework, there are a few key points I want to highlight to ensure clarity and confidence for everyone—especially for my existing clients, long-time collaborators, and new industry players looking for a stable solution.

1) This payment setup is 99.99% secure and stable.

If you are already working with us—or considering it—rest assured: our 2025 replica e-commerce payment solution has been tested extensively and is highly reliable. We rarely experience account bans or flagging. In the rare cases where issues do occur, they are almost always the result of the user’s own improper environment setup, usage behavior, or failure to comply with basic KYC norms. These are preventable with proper onboarding and usage protocols. If you follow the process, you’ll be safe.

2) This framework is ideal for small to mid-level daily volumes.

If your store processes a few hundred to a few thousand USD per day, this solution will work seamlessly. However, for stores moving more than $20,000 per day, and without access to a wide pool of account resources, we recommend using a dedicated payment channel, which falls outside the scope of this guide. High-volume replica merchants should consider enterprise-grade options.

3) Ongoing development and updates are required.

Like all stealth systems, this payment solution for AB replica sites requires continuous updates, monitoring, and code-level adjustments. If you’re a client working with us, you don’t need to worry about the technical side—we handle that. The information shared here is meant to help you understand the logic and stay informed, not to implement everything from scratch yourself.

Principle

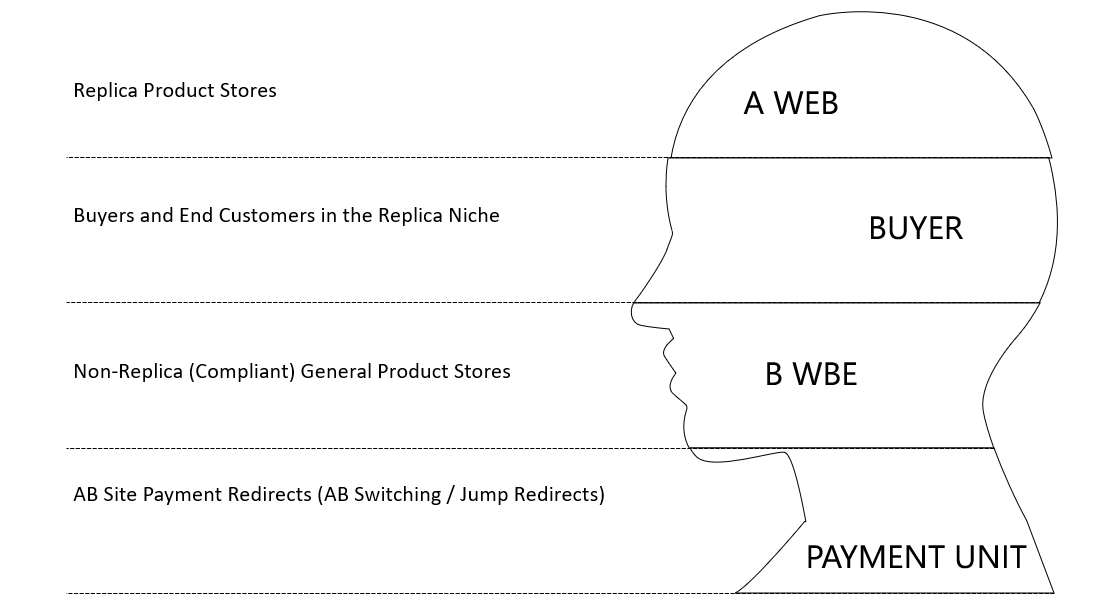

When it comes to receiving payments on replica e-commerce independent sites, almost everyone in the industry has heard of the AB model, AB redirects, or the so-called “rotating payment links”,

But let me be very clear: these methods alone are no longer sufficient in 2025.

While pure AB site redirects were once considered the standard approach, relying on them exclusively is now a major risk. Payment gateways and compliance systems have become much smarter, and pure redirect tactics are easily flagged, often leading to account bans, payment holds, and even upstream investigations.

To build a truly secure, long-term payment strategy for replica sites, you need to go far beyond basic redirects. A robust system must now include at least four critical layers of protection and logic:

(1) ✅ Real-time traffic filtering & payment behavior simulation

(2) ✅ Dynamic merchant account rotation based on risk signals

(3) ✅ Adaptive user-agent + fingerprint management (anti-fraud countermeasures)

(4) ✅ Geo-environment sandboxing to bypass region-based triggers

I’ll go into each of these in the next section. But the key takeaway is this: basic AB redirect structures are outdated, and only multi-layered payment architecture can keep your store running safely in today’s environment.

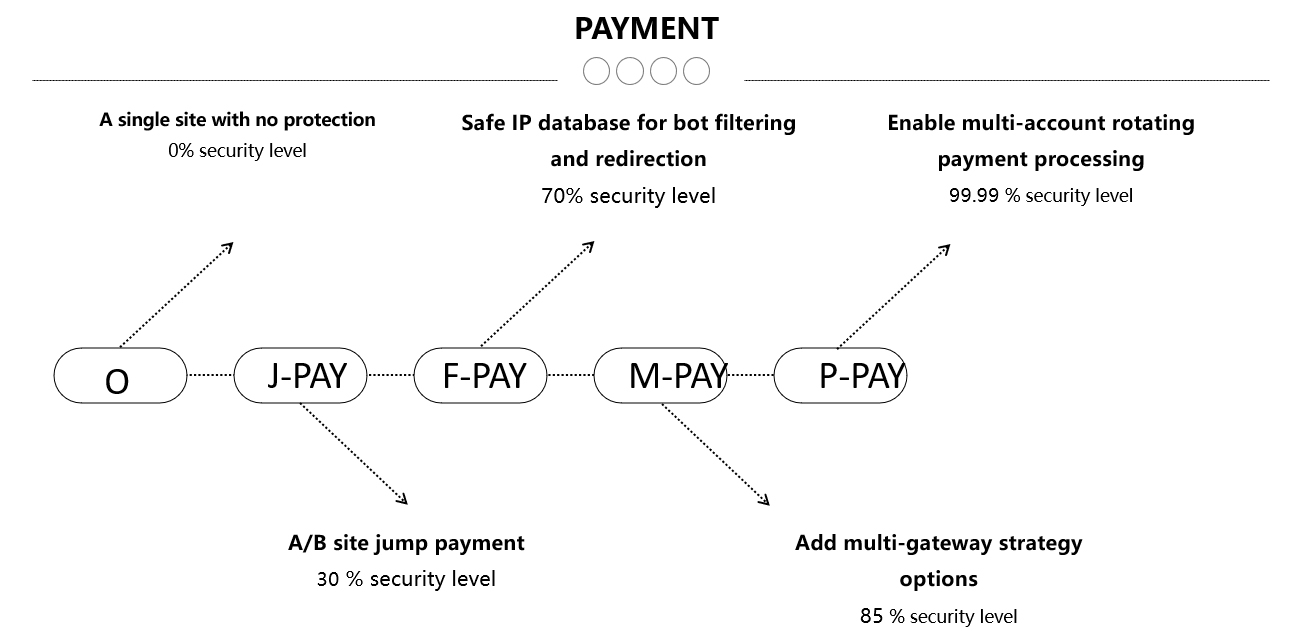

This is the four-part solution that my team and I have developed specifically for the replica e-commerce industry:

-

AB site framework (J-PAY)

-

Crawler filtering library (F-PAY)

-

Multi-gateway rotation strategy (M-PAY)

-

Rolling rotation system (P-PAY)

-

Fraud detection model (SCAM)

Only when all of these modules work together can we maximize the protection against account bans. From J-PAY to P-PAY, each added layer significantly increases the overall security and stability of the replica e-commerce payment system.

Now, let’s go through each module one by one.

① . AB Site Framework (J-PAY)

The AB site structure is a long-standing industry standard in replica e-commerce. No matter how the industry evolves, this foundational framework is here to stay—and for good reason. If you try to collect payments using a single site, directly and without any protection, platforms like PayPal or Stripe will almost instantly flag and ban your account.

In the J-PAY model, the process is simple but effective:

-

The buyer places an order on Site A, initiating a payment request.

-

Site A then notifies Site B, which matches the order to a general (non-branded) product.

-

Site B constructs a “clean” general merchandise order and executes the actual payment operation.

-

This sanitized order is then passed to PayPal, Stripe, or another PSP for processing.

This decoupled structure is the core of how replica stores safely process payments in 2025.

② . Crawler Filtering Library (F-PAY)

The AB site method first originated in China over a decade ago. But today, pure redirect strategies are no longer safe—companies like PayPal and Stripe are already very familiar with this tactic. In fact, they now work closely with major tech platforms like Google and Facebook to monitor and detect replica-related websites.

AB Site A, in particular, is often targeted for data scraping and scanning. Once Site A is flagged, it’s immediately classified as high-risk, triggering account restrictions or complete shutdowns.

The key threat comes from two types of visitors:

-

Bots and automated crawlers (used by platforms or security services)

-

Real human users (actual buyers)

F-PAY is designed to intelligently filter this traffic, identifying and blocking suspicious visitors in real time. This can be done through various methods, including the use of open-source APIs that check IP reputation, browser behavior, and device fingerprints.

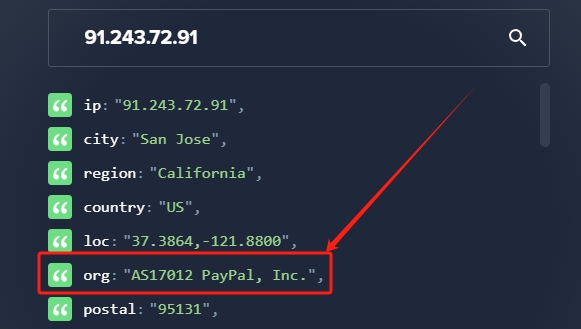

③. Advanced IP Monitoring and Anti-Crawler Strategy (F-PAY Continued)

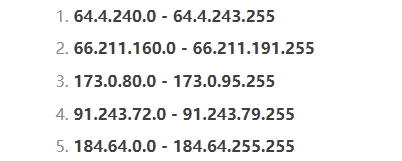

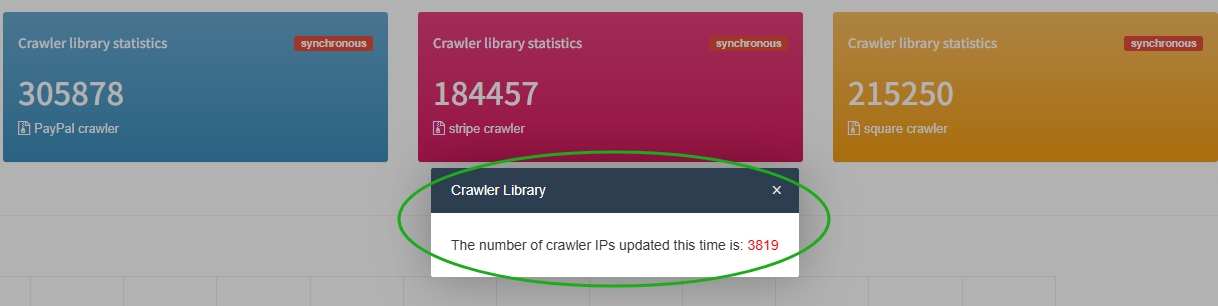

In our system, we conduct deep monitoring of high-risk IP ranges, especially those suspected to belong to PayPal bots or compliance scanners. Once a suspicious IP is identified, it is automatically stored in our internal replica site IP database for faster recognition and response in future visits.

Regularly updating this database is critical. Our system actively collects and parses PayPal IP lists from official sources as well as niche overseas tech blogs.

This ongoing maintenance is one of the essential technical tasks for running a stable replica payment infrastructure.

This is exactly why we always emphasize:

“A replica independent site’s payment logic must be regularly updated—

not left running on a static, outdated source code base.”

Just like PayPal, Stripe also continuously pulls crawler IPs from public threat libraries and scrapes suspicious domains for classification.

And importantly:

When an incoming visitor’s http.user_agent is detected as a crawler or bot, it should not be met with a simple 404 error. Instead, the system must redirect them to a safe, compliant-looking page to avoid triggering suspicion or audit flags. This is the correct way to bypass crawler detection in a compliant, stealthy manner and protect your payment account from being reviewed or shut down.

④. Multi-Gateway Switching Strategy (M-PAY)

To reduce the risk of account bans, some merchants use simple gateway rotation, meaning multiple accounts take turns processing payments. While this spreads the load and lowers the chance of a single account being flagged, many clients who came to us after leaving other providers reported a major flaw: their previous systems only implemented B-side (Site B) distribution, and used basic round-robin switching, with no intelligent logic.

Unfortunately, this kind of naive strategy is still easily detected by platforms like PayPal and Stripe.

The optimal solution is to simulate natural user behavior, making it appear to these gateways that your usage is compliant and organic. To achieve this, we introduce smart strategies on Site A, such as:

-

Payment gateway selection based on time of day

-

Region-specific gateway allocation

-

Randomization of transaction amounts, frequency, and order value

-

Adaptive logic to mirror realistic human patterns

This ensures a far more secure and believable payment flow.

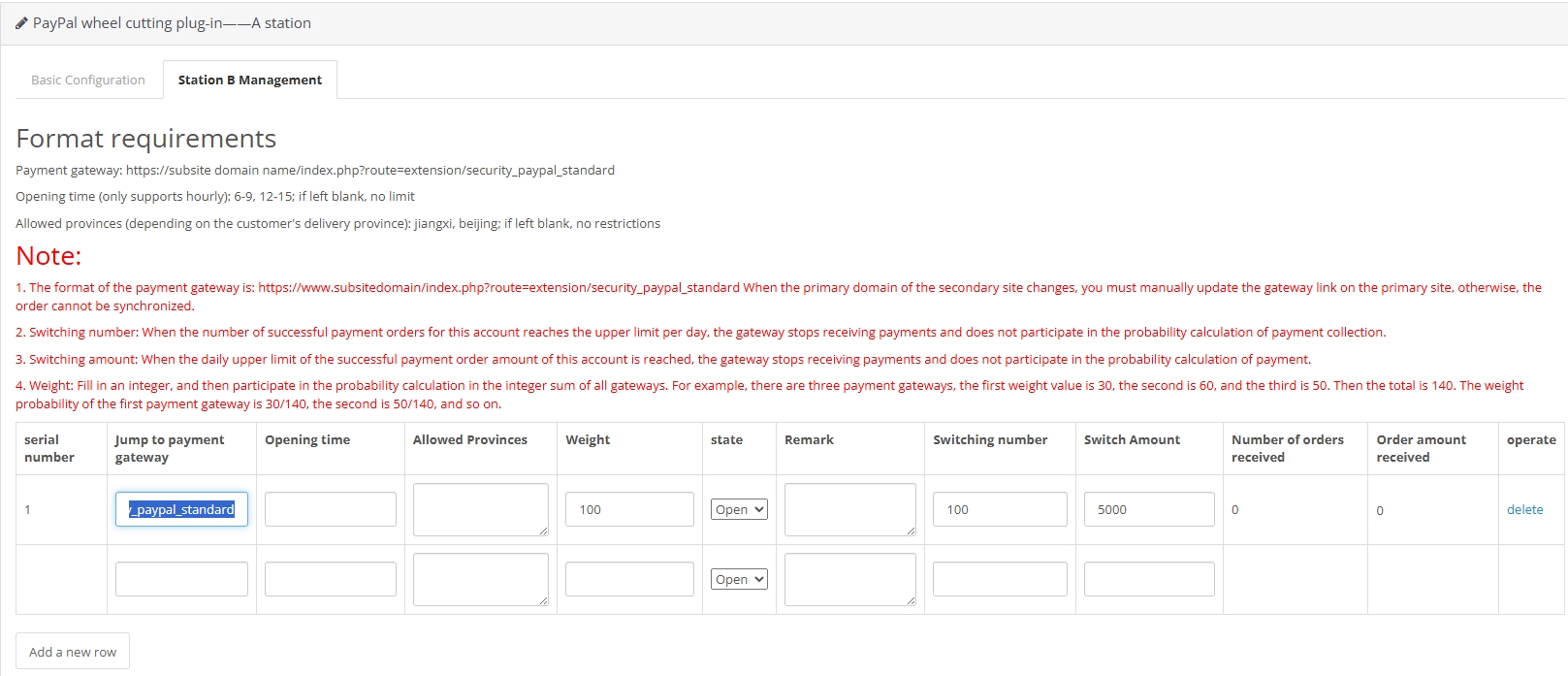

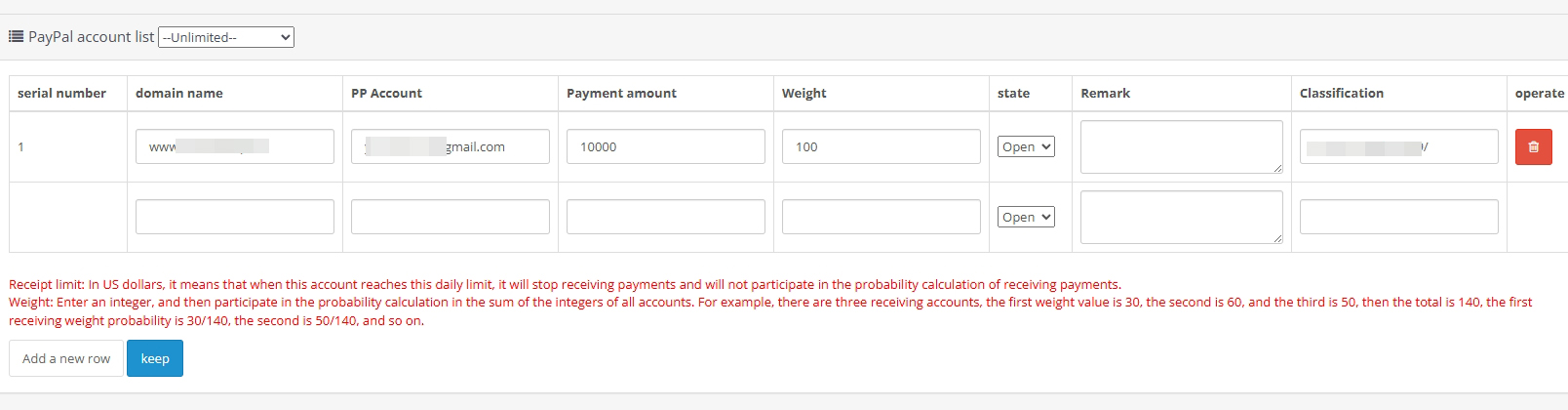

⑤. Multi-Account Rolling Rotation (P-PAY)

In addition to A-side strategies, we implement a second layer of protection on Site B, using rolling logic between multiple merchant accounts. The system dynamically selects accounts based on:

-

Payment weight

-

Daily volume limits

-

Custom threshold settings

By combining M-PAY and P-PAY, we move from a rigid structure to a flexible, multi-to-multi dynamic, where Site A intelligently chooses the best-fitting Site B account in real time.

For small to medium-sized sellers, who typically don’t process high daily volumes, even a simplified one-to-many model can fully handle daily payments while staying under the radar of major PSPs.

⑥. Fraud Detection Model (SCAM)

This module is an exclusive technology developed by my company specifically for replica independent site payment systems. To this day, my technical team and I continue to use it whenever we build new independent stores or custom payment gateways for our clients.

The SCAM detection model helps identify high-risk behaviors, suspicious orders, and potential gateway traps, providing an added layer of protection that goes beyond standard bot filtering or account rotation. It’s a core part of why our payment solutions remain stable, stealthy, and reliable in 2025.

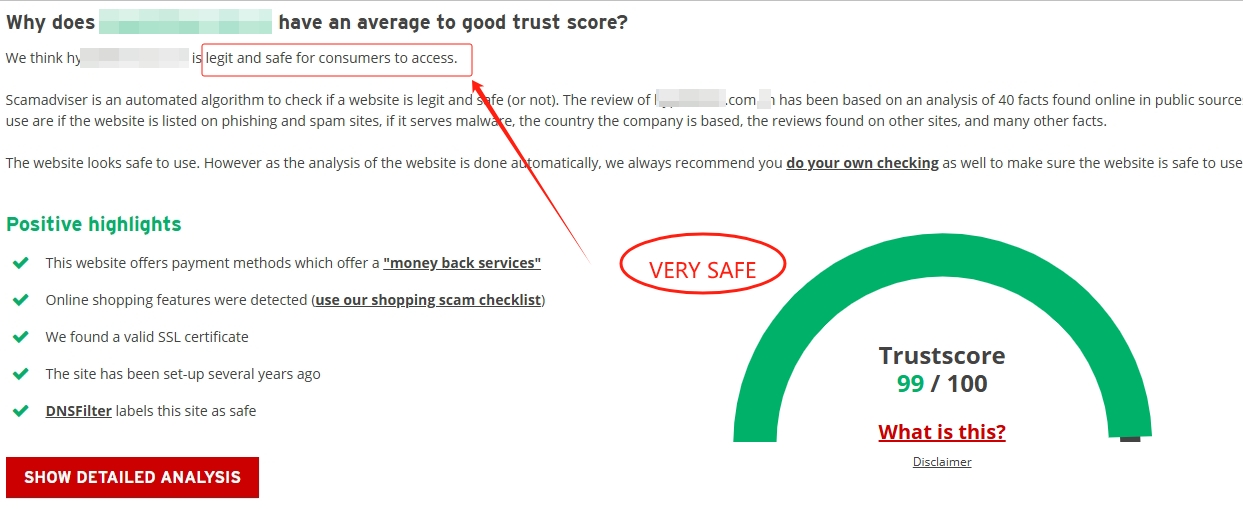

Our SCAM fraud detection model consistently achieves a near-perfect 99 out of 100 trust score under industry evaluation metrics. This significantly improves the trustworthiness of our sites in the eyes of companies like PayPal and Stripe.

These platforms also rely on big data-driven SCAM detection systems to monitor millions of online payment sites. Each site is evaluated using automated systems that assign a trust score. Only sites with high scores avoid triggering account reviews or restrictions. That’s why maintaining a high trust score is critical for long-term account stability and uninterrupted payment flow.

Before any AB-site system goes live, we perform multi-layer trustcore checks to ensure full compliance with risk control standards. My team and I treat this as a non-negotiable final security gate, ensuring the payment modules are safe and production-ready.

Custom E-commerce Solutions for High-Quality Designer-Inspired Fashion Replicas | Website Development, Dropshipping, Payment Integration for PayPal and Stripe, Ad Cloaking Services

Custom E-commerce Solutions for High-Quality Designer-Inspired Fashion Replicas | Website Development, Dropshipping, Payment Integration for PayPal and Stripe, Ad Cloaking Services

![5 Best WordPress Themes for Replica Product International Trade Websites [Recommended]-Custom E-commerce Solutions for High-Quality Designer-Inspired Fashion Replicas | Website Development, Dropshipping, Payment Integration for PayPal and Stripe, Ad Cloaking Services](https://replicasmaster.com/wp-content/uploads/2025/06/1-1-220x150.jpg)